Published October 24, 2012

Energy Price Outlook

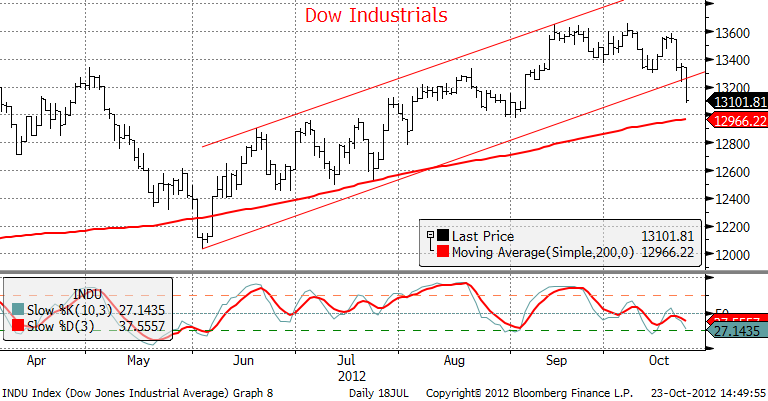

Oil prices may continue their short-term correction over the next few days, with support in WTI offered between $81.00 and $85.00/bbl. We think that the rate of decline will slow in the near-term, as some of the impulsive selling and weak longs have exited the market. A focus will be on the FOMC announcement today, but little change in policy is expected after the last meeting's implementation of QE3. Pressure may continue to be offered by a lower stock market, which has weakened based on disappointing earnings and signs of a sluggish economy. Oil prices may also fall due to high levels of oil inventories and oil production, as well as relatively weak demand. We would trade WTI as a negative affair this week and then look for prices to eventually stabilize in the $81.00-$85.00/bbl range. A hold in the Dow near 13,000 support would assist oil prices in forming a bottom (psychological support, the Sep 4th low, and the 200-day MA).

Yesterday's trade in WTI finished $1.98/bbl lower yesterday, as pressure was attributed to a weaker economic outlook and a selloff in the stock market. Both of those issues stemmed from poor earnings numbers from DuPont, 3M, and United Technologies. DuPont announced 1,500 jobs would be cut and fell the most out of the three. Despite earnings being the largest blame for the selloff, we wonder too how much the Fed and the election had to do with it. It was just a few weeks ago that FedEx and Intel made earnings warnings, but the selloff didn't appear to be as large. With regards to the Fed, the NYT reported yesterday that Fed Chairman Bernanke will not stand for a third term when his current term expires in Jan '14. That may have lessened the market's expectations that QE would be extended or enlarged after he potentially leaves. With regards to the election, Monday night's debate was said to be won by Pres Obama, who is widely regarded as being negative for stocks and likely to maintain a sub-par pace of economic recovery. Oil demand would suffer under such a circumstance and may have been partly to blame yesterday. These suggest that oil prices and stocks may drift gradually lower until either Mr. Bernanke denies the NYT story and/or poll results show little change once Monday's data is factored. There's also the possibility that markets could remain under pressure until the election, which is less than two weeks away.

Other factors still lean negative on balance for oil prices too. Elevated levels of domestic oil production is one of them, while high oil stocks is another. Today's update by the EIA on oil inventories will be key. Seasonal factors are negative for most energy markets through year-end, as we've detailed in this report previously. The economy is a slight negative on the margin too, as the poor earnings numbers are emblematic of last week's jobs data shown through the jump in unemployment claims and poor showing in the Philadelphia Fed employment component. Yesterday's Richmond Fed index was -7 vs. +4 and also show weakness. These should outweigh support from improved Chinese imports, Iran's plan to halt exports if sanctions are tightened, and Iran's "Muddy Waters" plan to close the Strait of Hormuz.

Natural Gas

Yesterday's trade closed +8.3 cents in Nov and +9.3 cents in Dec. The front month of the curve did the best and unwound a large portion of the 16.5 cent selloff witnessed on Monday. Support for the front end was given by cooler weather forecasts by Earthsat, which predicted below-normal temperatures in the eastern half of the U.S. over the next 6-10 days. The forecast was similar to what NOAA maps have been showing over the last several days as well. The NHC said that Tropical Storm Sandy formed in the Caribbean but will head straight north over Cuba and eventually east of Florida. We wouldn't attribute any of yesterday's strength to the storm, as oil prices didn't react to it and would have suffered a greater impact than would have natural gas.

Today's trade will focus on technical factors and the potential that upside momentum in the past month can be maintained. Open interest has increased 135,000 contracts since Sep 25th while prices are about 50 cents higher. That signals that investors have moved into the market en masse over the last month. At the same time, a note of caution can be taken from the commitment of traders data on Friday. The data is through Oct 16th and doesn't capture the rally that took place late last week, but it showed that the managed money net long fell 7,759 while non-commercials were down 6,613. We would look for the sideways-to-higher trend to continue this week and for prices to re-test the $4.00 level.

Global Economic & Dollar News

- The Bank of Spain's monthly report showed that GDP probably shrunk 0.4% in Q3 vs. -0.2% in Q2 and consensus for a decline of 0.7%. The Q3 GDP number is due on Oct 30th.

- The Spanish Gov't said that it can't be ruled out that it may miss its 2012 budget deficit target due mainly to shortfalls of tax revenue.

- Moody's Downgraded five Spanish regions including Catalonia by one to two notches. The agency cited limited cash reserves and forthcoming bond repayments. Moody's affirmed the national Spanish government's rating last week.

- Fed Chairman Bernanke has reportedly told close friends that he will not stand for a third term when his current term expires in Jan '14.

- United Tech, DuPont, and 3M reported earnings yesterday that missed expectations. DuPont announced 1,500 jobs would be cut.

- The Richmond Fed Index fell to -7 in Oct from +4 in Sep.

- UBS will cut 400 jobs starting Wednesday and may cut more after its earnings release.

- Dow Chemical is considering cutting 2,400 jobs, or 5% of its workforce.

Energy News

- Iran's Oil Minister said that his country would stop oil exports in the event that the West tightened sanctions further. He added that he had a "Plan B" strategy to survive without oil revenues.

Upcoming Energy Events

Wed - Chinese HSBC MFG PMI Wed - New Home Sales

Wed - EIA Weekly Oil Inventories (10:30am EST) Wed - FOMC Meeting

Thu - Durable Goods Orders

Thu - Natural Gas Inventories (10:30am EST) Tue - API Inventories (4:30pm EST)

Analysis

EIA Inventory Preview

Last week’s inventory figures added pressure on the oil market despite a surge in overall demand. Oil production remained at 17-year highs while imports grew, which caused inventories to be reported above expectations. This week may see a similar mix of undercurrents, whereby production could increase again and imports stay firm. Refinery utilization may increase slightly, but it has underperformed the five-year average. The rate of utilization usually bottoms in the w/e Sep 21st and gains 0.8% through last week. This year’s numbers, however, are unchanged since Sep 21st possibly as a result of weak refinery margins based on high Brent crude oil prices. If utilization gains only slightly as we suspect, it will do little to remove the excess inventories of crude oil that have accumulated. We also anticipate demand to fall this week, as it tends to be volatile. Last week’s surge was led by a counter-seasonal increase in the “other oils” category which is also volatile. Product inventories may fall based on low utilization rates and stagnant demand. We look for declines that match the five-year averages in gasoline and distillates of 0.7 MB and 1.5 MB respectively.

Natural gas inventories could match the gain in the five-year average of 66 bcf on Thursday. Heating demand fell from last week, with NOAA’s HDD count at 62 compared to 81. Last week’s degree day total was somewhat high for the time of year, and we suspect didn’t yield the heating demand that would normally be the case if it had taken place in December or January. In circumstances similar to last week, our model projects a low reading of between 40 and 52, however, similar degree day readings a year ago in the w/e Oct 20th yielded a strong inventory build of 92 bcf. This year’s numbers have also been positively impacted by higher production and negative impacted by higher demand, which causes us to favor a reading closer to the mid-point.

Editor’s Note: Daily Energy Report readers who are equity investors/traders only can gain access to the energy space through the following exchange traded funds (ETFs).

WTI Crude OIL

United States Oil (USO, quote)

Power Shares DB Oil Fund (DBO, quote)

Brent Crude Oil

United States Brent Oil Fund (BNO, quote)

Natural Gas

United States Natural Gas Fund (UNG, quote)

United States 12 Month Natural Gas Fund (UNL, quote)

First Trust ISE-Revere Natural Gas Index Fund (FCG, quote)

Coal

Market Vectors Global Coal Index (KOL, quote)

Power Shares Global Coal Portfolio (PKOL, quote)

IMPORTANT NOTICE: Trading of commodities and commodity futures and options, and other commodity derivatives has substantial risk of loss, and is not suitable or appropriate for all persons. Past results are not necessarily indicative of future results. The information in this piece is based on sources that are believed to be reliable, but it is not warranted to be accurate or complete, and no performance or results from use of the information are warranted. This piece is not a solicitation or offer to purchase or sell commodities or commodity derivatives. Opinions expressed herein are subject to change without notice.

You must be logged in to post a comment.